LINE Bank to Firstrade Transfer|Fast Deposit & 150 NT Fee Guide with Account Upgrade & Fee Subsidy

Discover how LINE Bank users can deposit to Firstrade quickly with just a 150 NT fee, complete account upgrade steps, scheduled transfers, and fee subsidy applications—all explained with clear visuals for seamless transactions.

点击这里查看本文章简体中文版本。

點擊這裡查看本文章正體中文版本。

This post was translated with AI assistance — let me know if anything sounds off!

Table of Contents

Step-by-step Guide — LINE Bank Deposit to Firstrade with Fast Credit, Only 150 TWD Fee, and Account Upgrade/Auto Transfer/Fee Reimbursement Application Tutorial

Line Bank Deposit to Firstrade and Complete Step-by-Step Guide for Account Upgrade, Agreement, and Fee Reimbursement

Advantages of LINE Bank

Easy Account Opening: If you have credit records with other banks, you can open an account by simply filling out the information online.

Interbank transfers free of charge: up to 50 times/month

Seamless LINE Transfer Integration: No need to use iPASS MONEY for transfers between friends

Currency exchange available 24 hours a day

Multiple flexible high-interest deposit plans available for you to mix and match

Personal Loan: Fast / Integrated / Easy 10-Year Repayment

Securities: Invest in Taiwan stocks starting from 100 NTD

Until 2025/12/31 — US remittance fee only 150 NTD

This is the biggest incentive for using LINE Bank. Until the end of 2025, funding Firstrade with a LINE Bank account only incurs a 150 TWD fee, with no telegraph or other charges.

Click here to apply

Disadvantages

This time, setting up a designated account requires LINE Bank to verify through the National Identification Card since it has no physical branches; therefore, you need to visit the household registration office to apply for the card before use, which is more troublesome than going directly to a bank.

Advantages of Firstrade

Account opening, interface, and features are simple and beginner-friendly for U.S. stock novices

Supports Chinese interface

Trading with zero fees

Established Broker

Please make sure to use the name on your passport.

Deposit over $10,000 USD to apply for a fee rebate up to $25 USD

Deposit over $10,000 USD to apply for a wire fee rebate up to $25 (up to three times per month)

Once the account is fully set up, we can start funding it.

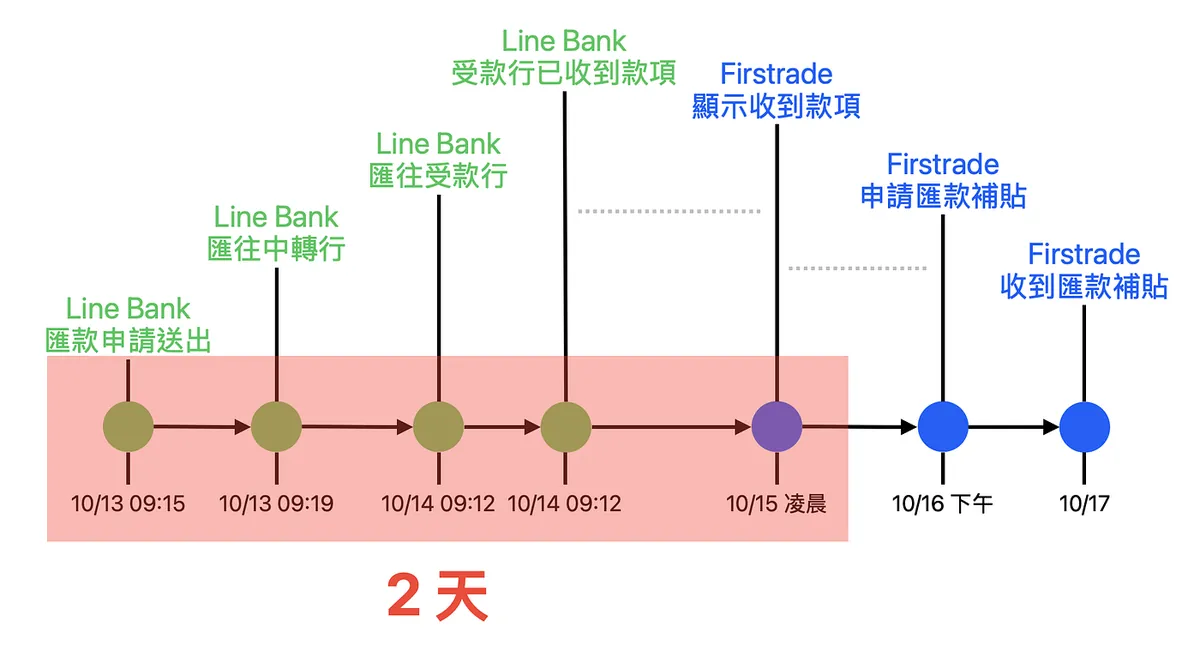

Timeline Reference for Deposits (Fastest 2 Days to Account Credit)

Here is the timeline from my deposit to Firstrade on 10/14 until I received the remittance subsidy.

Please note that the above assumes the designated account has already been linked or the amount is less than 50,000. The first time linking a designated account takes an additional 2 days to become effective.

Line Bank shows the beneficiary bank has received the funds, but there is a delay before Firstrade actually receives the money. (It likely waits until Firstrade completes processing during business hours before showing as received)

There may be a delay in applying for the remittance subsidy (for single transfers over $10,000) after Firstrade receives the funds. If you don’t see the record, please check again later or the next day.

LINE Bank Deposit to Firstrade

First, let’s introduce how to deposit from Line Bank to Firstrade.

Deposit Your Assets into Firstrade

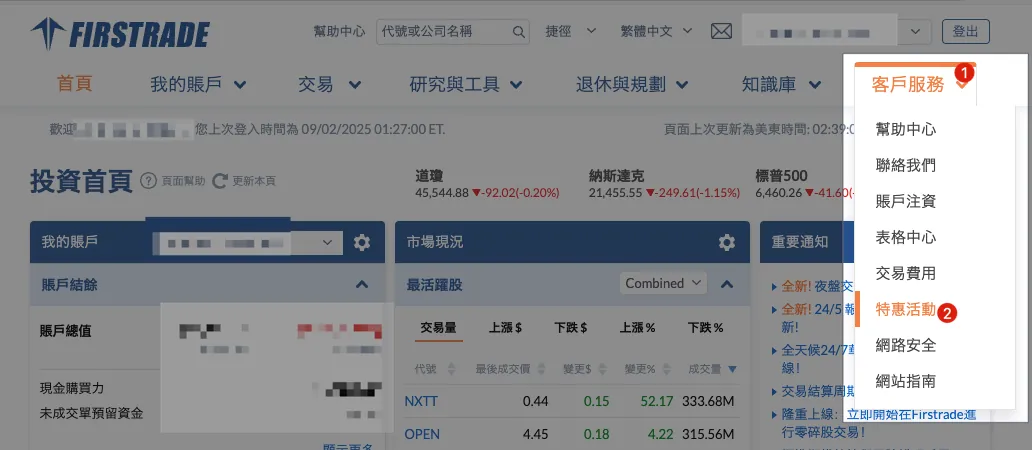

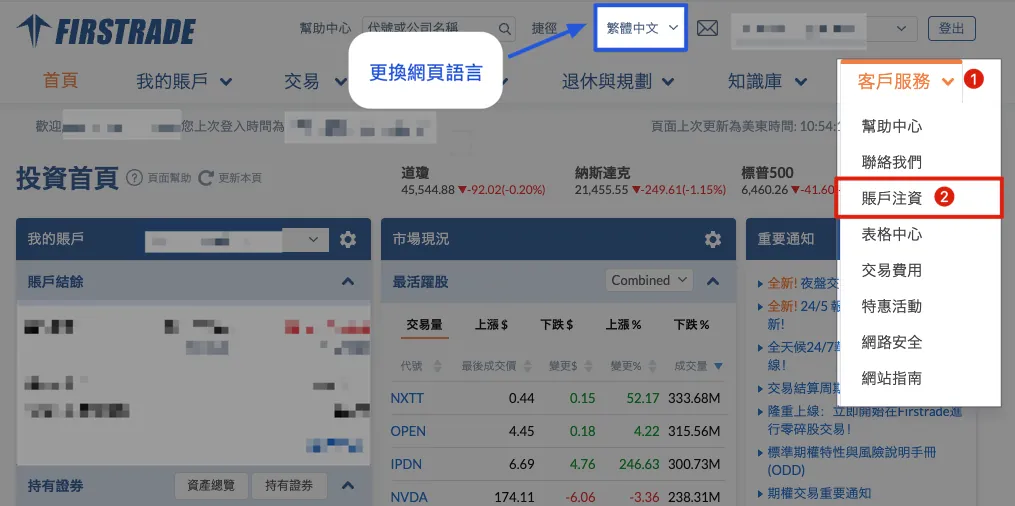

(Please use the desktop version) After logging into Firstrade, select:

Customer Service

Account Funding

If the page is in English, you can select “繁體中文” at the top to change the language.

Get Wire Transfer Information

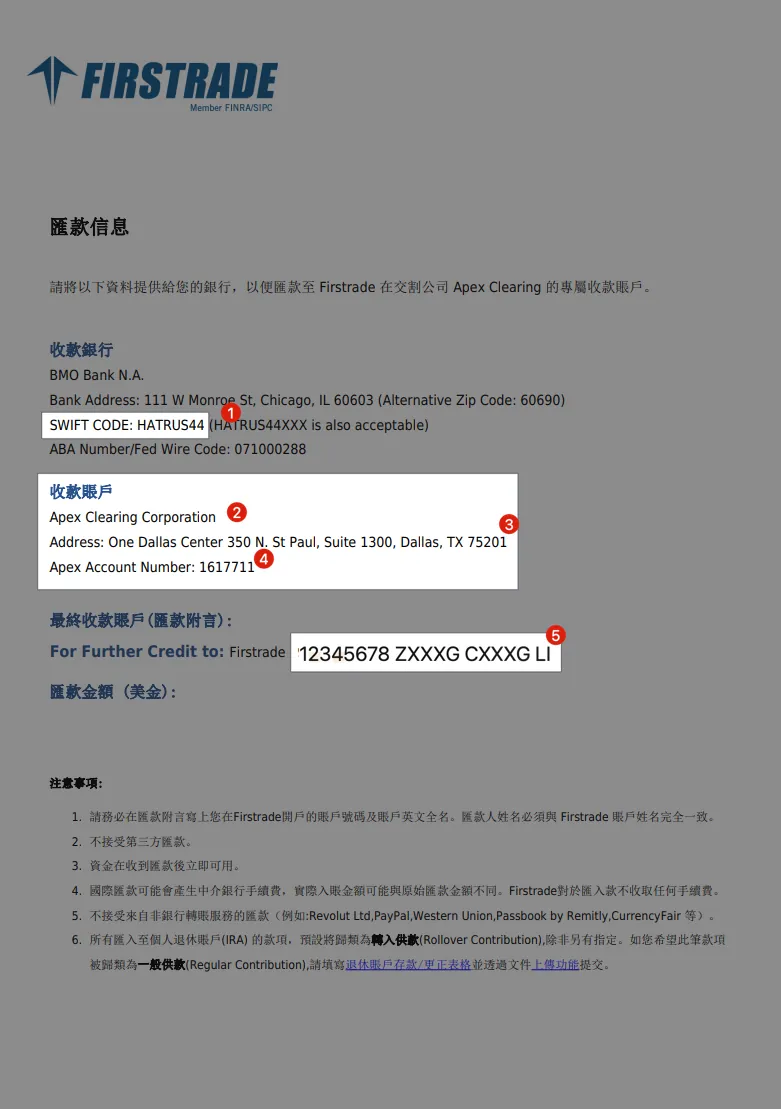

Select “Remittance” → “Remittance Information” to open a PDF file, which you can save for easy reference when making deposits later:

Receiving Bank Information — SWIFT Code

Beneficiary Account Name

Recipient’s English Address

Recipient Account Number

Memo

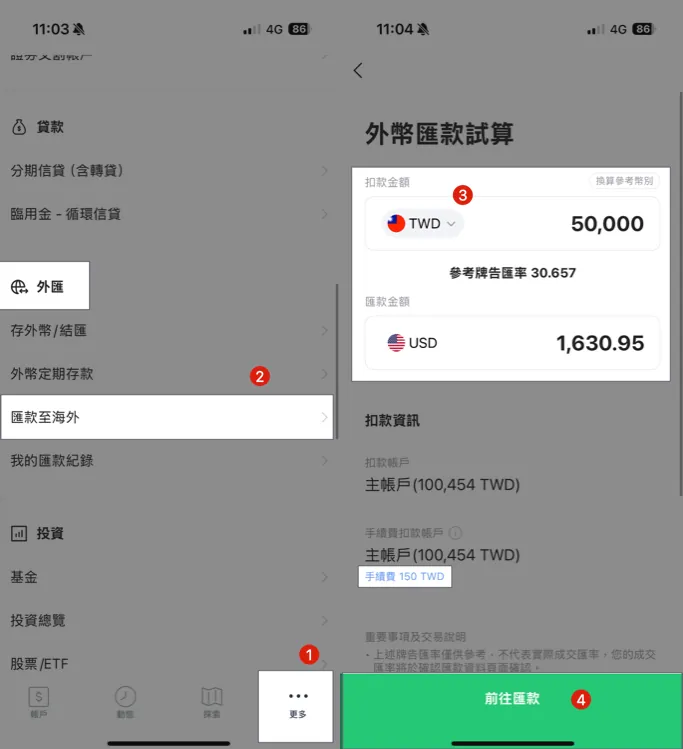

LINE Bank App — Remittance to Overseas

Click “More”

Scroll down to the “Foreign Exchange” section → Click “Remit Overseas”

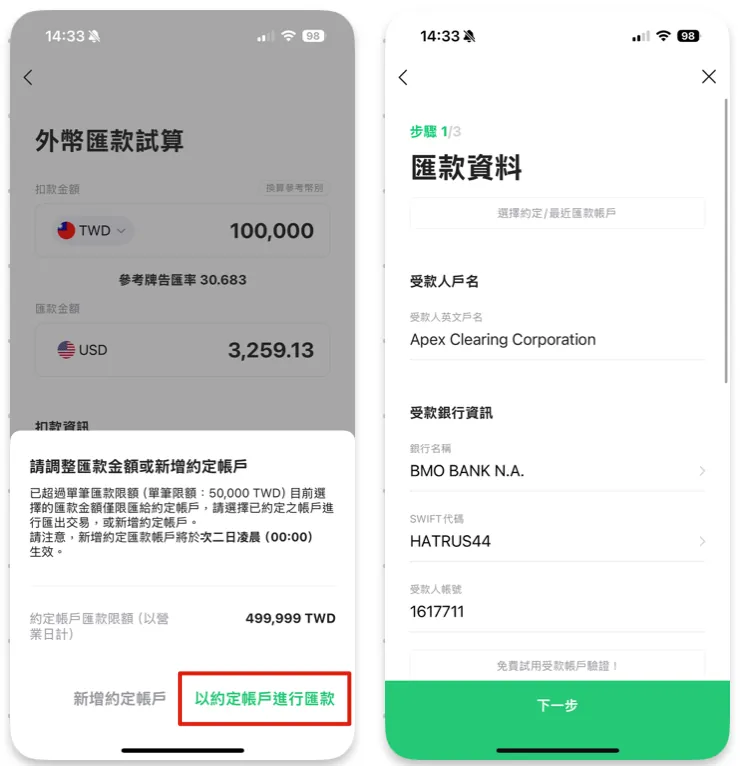

Select the debit amount in “TWD or USD” and enter the transfer amount.

Please refer to the Line Bank account upgrade and designated account binding tutorial below first.

Please refer to the Line Bank account upgrade and designated account binding tutorial below first.

Please refer to the Line Bank account upgrade and designated account binding tutorial below first.

Otherwise, you can only transfer up to 10,000 TWD.Click “Proceed to Remittance”

Fee Rate (Flat $150 until 2025/12/31)

Remittance NTD $10,000 / Fee NTD $150 = 1.5%

Remittance NTD $50,000 / Fee NTD $150 = 0.3%

Remittance NTD $300,000 / Fee NTD $150 = 0.05%

Remittance NTD $500,000 / Fee NTD $150 = 0.03%

The larger the amount per transfer, the lower the rate. For Firstrade single deposits over $10,000 USD (about $310,000 TWD), you can apply for a fee rebate of up to $25 USD, up to three times per month. The application must be made within 30 days after the transfer (see the tutorial at the end).

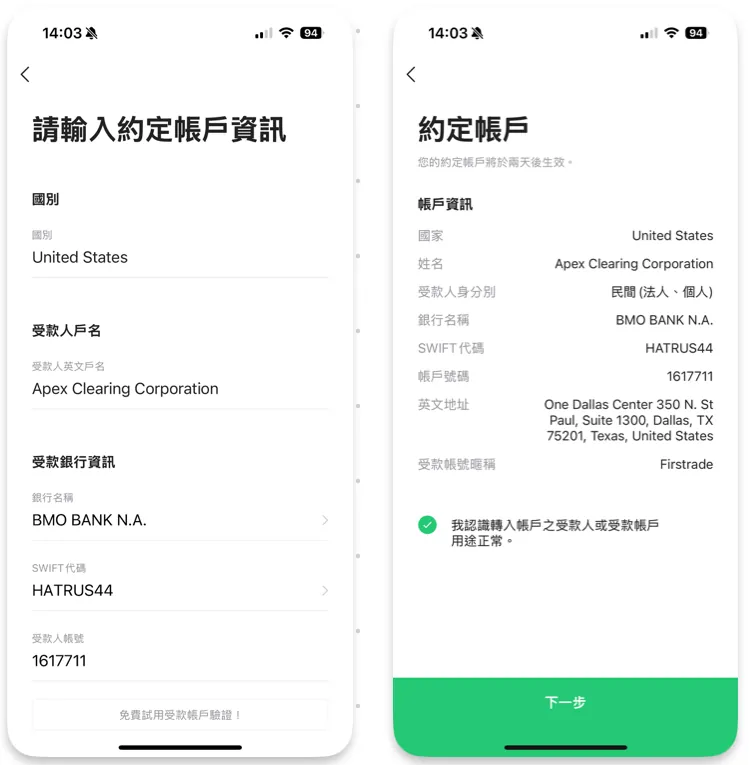

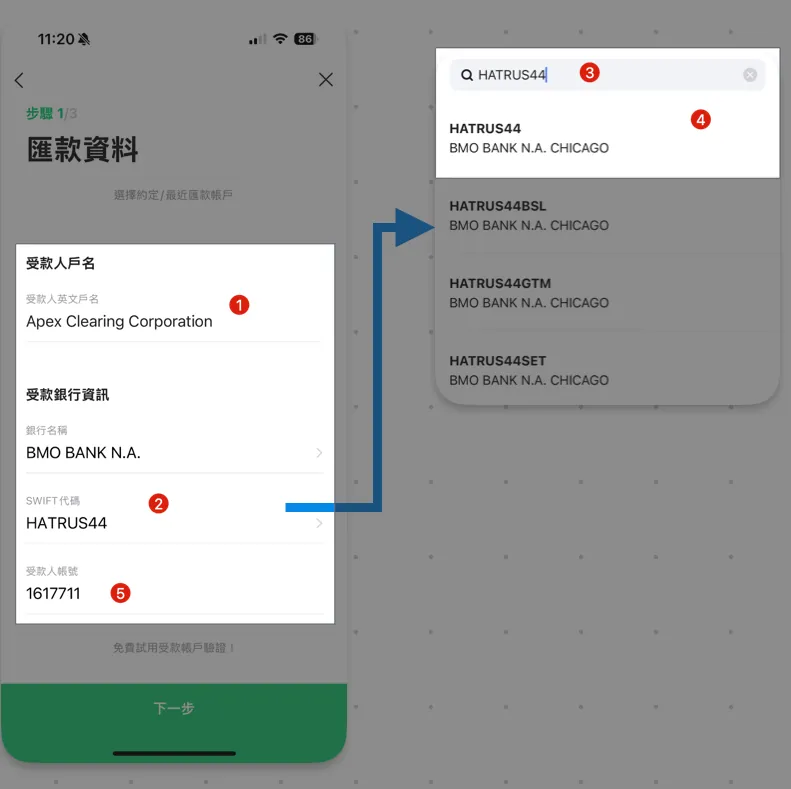

Enter Remittance Information

Enter the information from the previous step Wire Transfer Instructions:

Recipient’s English Account Name:

Apex Clearing CorporationBeneficiary Bank Information — Automatically filled by entering the SWIFT code directly

Enter search:

HATRUS44Choose the first one:

HATRUS44 — BMO Bank N.A CHICAGORecipient Account Number:

1617711(May change, please refer to actual information)

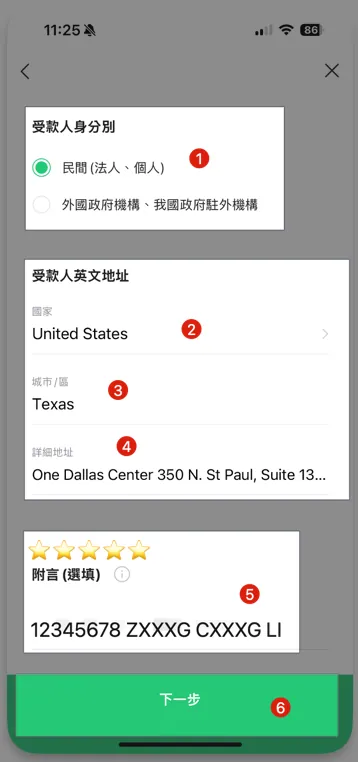

Scroll down to continue input:

Recipient Type:

Private (Corporate, Individual)Recipient’s English Address — Country: Select

United StatesRecipient’s English Address — City/District: Fill in

TexasRecipient’s English Address — Detailed Address:

One Dallas Center 350 N. St Paul, Suite 1300, Dallas, TX 75201(Refer to the previous remittance information)⭐️️️️️️ The most important memo, please be sure to fill it in

⭐️️️️️️ The most important memo, please be sure to fill it in

⭐️️️️️️ The most important memo, please be sure to fill it in

Enter according to the previous remittance information:8-digit account number + account name

As shown above:12345678 ZXXXG CXXXG LIClick “Next”

Nature of the Remittance

Select “262 Investment in Foreign Equity Securities”

Click “Agree” to acknowledge the important notes

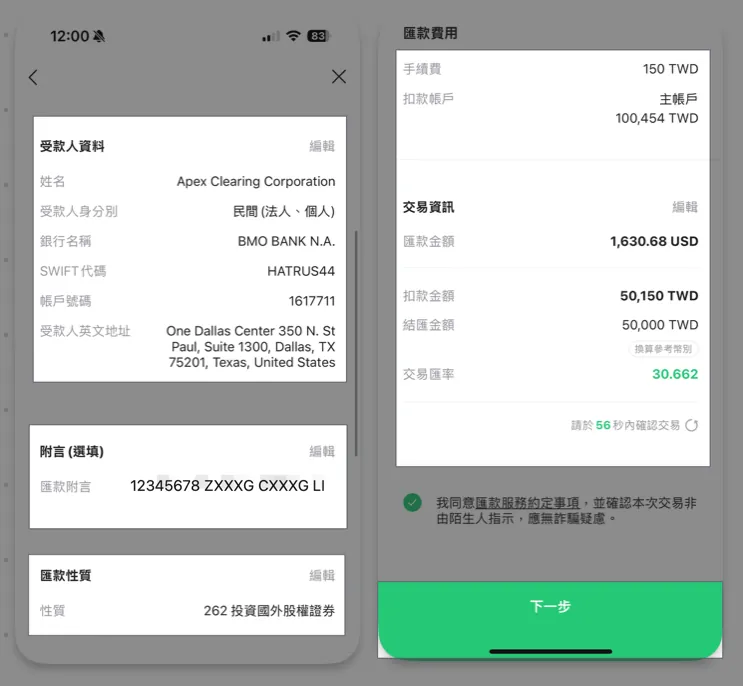

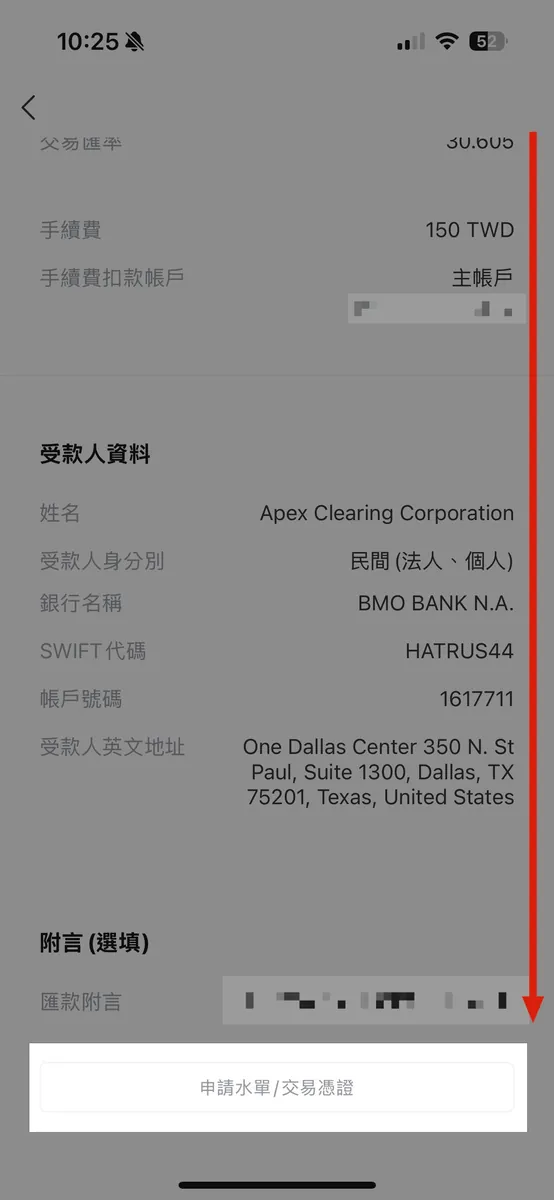

Remittance Confirmation

The final step is to verify that the information entered is correct, especially the recipient account details and the memo section.

If the transaction details cannot be confirmed within 60 seconds, the exchange rate quote may be updated.

No problem, click “Next” to complete the remittance application.

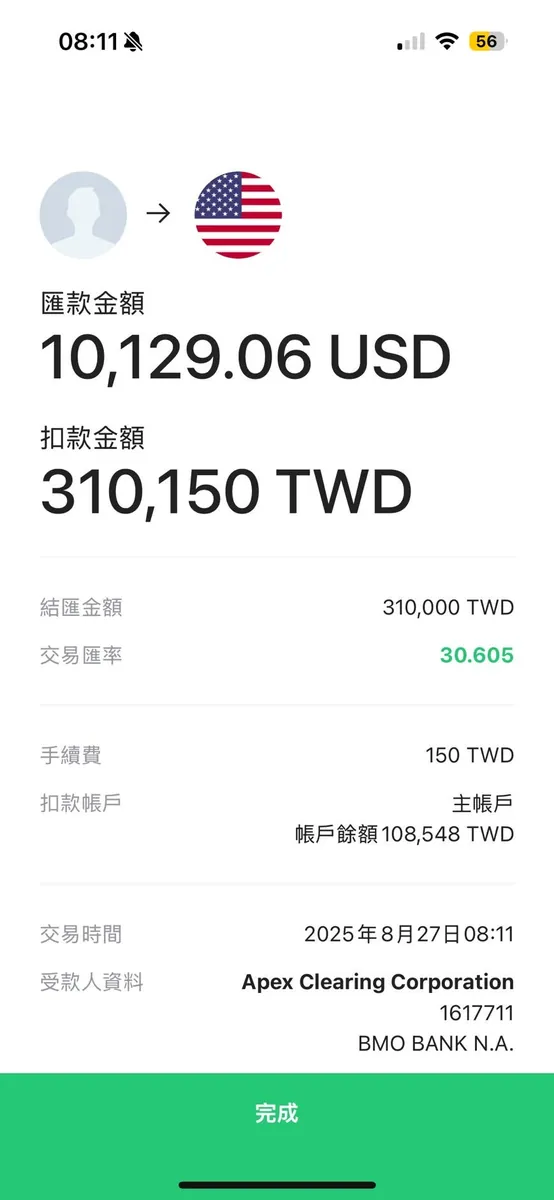

Completed

Seeing this screen means your transfer request is complete. Please wait for the deposit notification.

The remittance amounts shown in the images are for reference only. (Some images show 50,000, others 100,000)

LINE Bank Remittance Deposit Firstrade Progress Inquiry

You can find the foreign currency transfer notification in the top right corner of the LINE Bank App. Click it to check the transfer status.

On non-holidays, the transfer can be completed on the same day at the fastest. On holidays, it will be processed on the next working day after two days.

If the recipient information is incorrect, the payment will be rejected, and you will need to pay a return transfer fee to resend the payment

Applying for a Remittance Slip (Transaction Record/Receipt)

Line Bank App progress inquiry notification (as mentioned above), scroll down to find a “Request Deposit Slip/Transaction Receipt” button. Clicking it will send the remittance slip to your email, which you can open using your ID number.

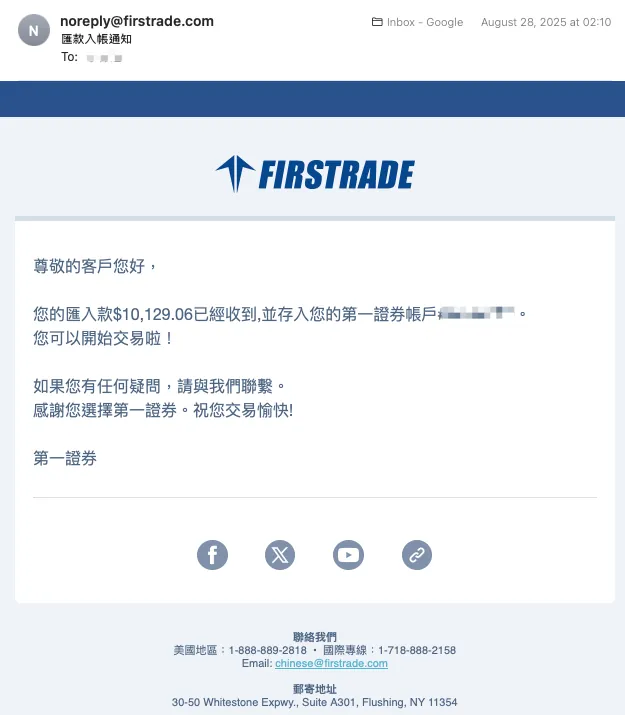

The receiving bank has received the funds, but Firstrade does not see the deposit?

This is normal. Although the remittance status on Line Bank shows “Receiving bank has received the funds” and the transfer is complete, Firstrade still needs to wait for a US business day (time) to confirm the funds.

As shown in the image above, although the funds were received on 8/27 at 09:00 AM, Firstrade only confirmed the funds and sent the deposit notification email at 8/28 02:10 AM:

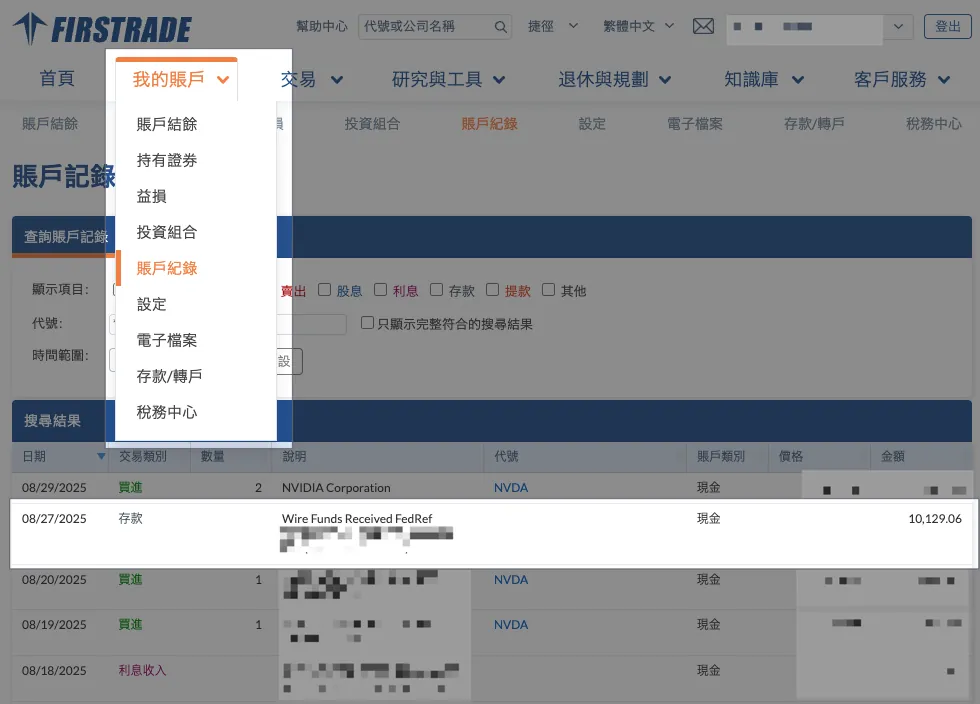

At this point, log in to Firstrade to see the funds credited and start trading US stocks:

“My Account” → “Account Records” will also have deposit records available for inquiry.

Line Bank Account Upgrade and Binding Designated Account Tutorial

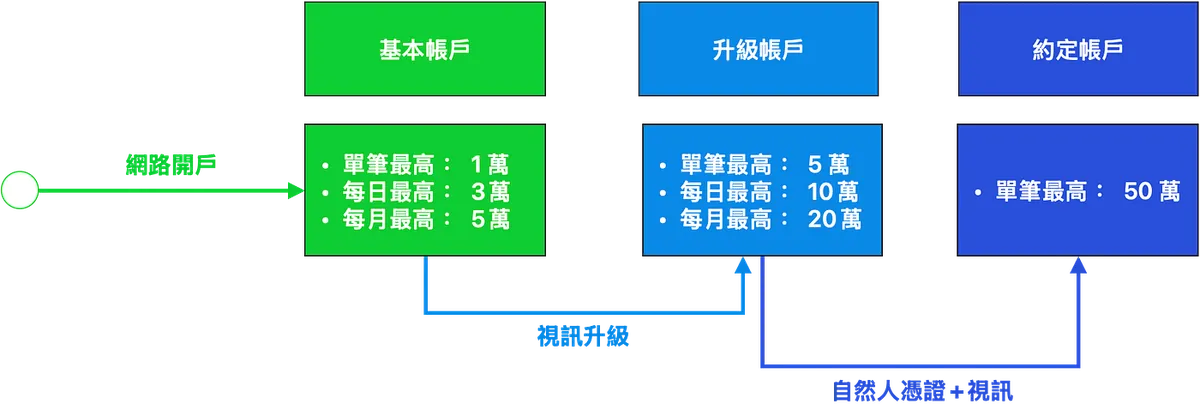

Benefit Comparison:

(After account opening) Basic account: maximum NT$10,000 per transaction, NT$30,000 per day, NT$50,000 per month.

(After customer service video verification) Account upgrade: maximum NT$50,000 per transaction, NT$100,000 per day, NT$200,000 per month.

(After Natural Person Certificate + Customer Service Video Verification) Designated Account: maximum single transaction limit of NT$500,000.

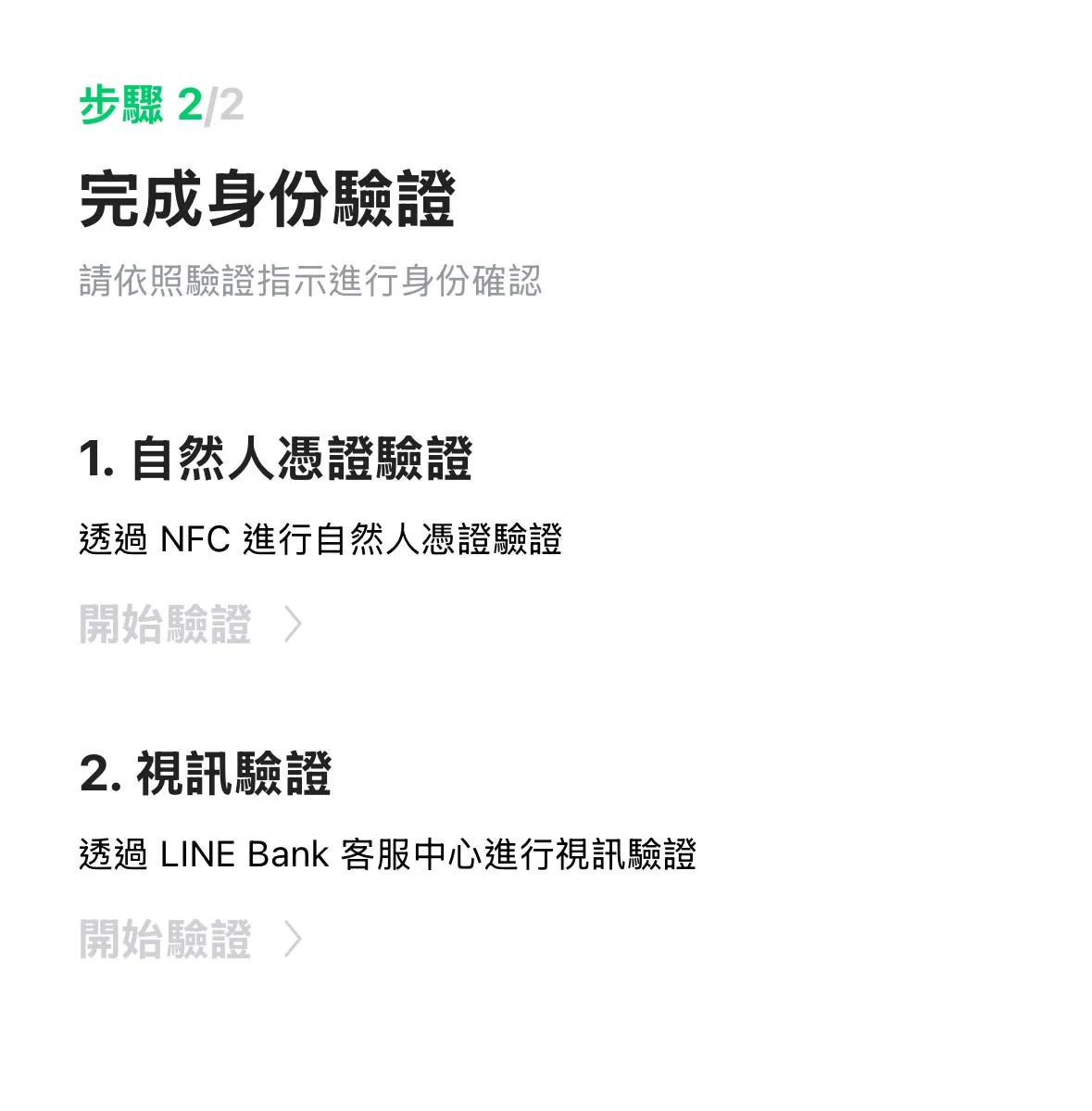

Line Bank Account Upgrade

It’s basically upgrading to the basic limit of other banks. (This step does not require a National ID certificate.)

Open the LINE Bank App, scroll down under “More” to find “Others” → “Account Upgrade,” select the type of account to upgrade → choose 2. Video Verification “Start Verification >”.

Please first ensure your internet connection is stable.

Ensure that video call is currently available

Clicking will initiate a video call with customer service. You will need to have a video conversation with the agent, who may verify your account information (e.g., ask about your current balance). Once confirmed, your account upgrade will be complete.

Set Up Firstrade Remittance Account

It is recommended to directly set Firstrade’s remittance account as a designated account for convenience, speed, and security.

The designated account will take 2 days to become effective.

The designated account must first pass verification with a National Digital Certificate.

The Citizen Digital Certificate verification only supports cards starting with TP07, which contain an NFC chip

Applying for a Citizen Digital Certificate

Please first complete the online application form for the Citizen Digital Certificate:

Natural Person Application Form

After submission, you can complete the process at any household registration office counter within 7 days (it does not have to be your registered residence).

Processing Fee: $250

On-site processing and distribution

Few people apply for the National Identification Card at the Household Registration Office, which usually does not close during lunchtime.

Line Bank Add Designated Firstrade Overseas Remittance Account

Open the LINE Bank App → “More” → scroll down to Foreign Exchange, tap “My Remittance Records” → “Remittance Designated Account” → “Add Designated Account”.

First Time Use — Complete Account Verification

The first binding requires completing both “Citizen Digital Certificate Verification” and “Video Verification.” The video verification for account upgrade must be done via video call with customer service to verify account information.

For the Citizen Digital Certificate, you need to use the newly issued certificate card and complete the verification by tapping the card:

The NFC range of the citizen digital certificate is quite short. I tried several times before it worked; on the iPhone, hold the camera near the center of the card and move the card left and right. After a few tries, the verification will succeed.

Add a Designated Account

Fill in the account information in the same order as the remittance details introduced earlier. After confirming everything is correct, click “Next.”

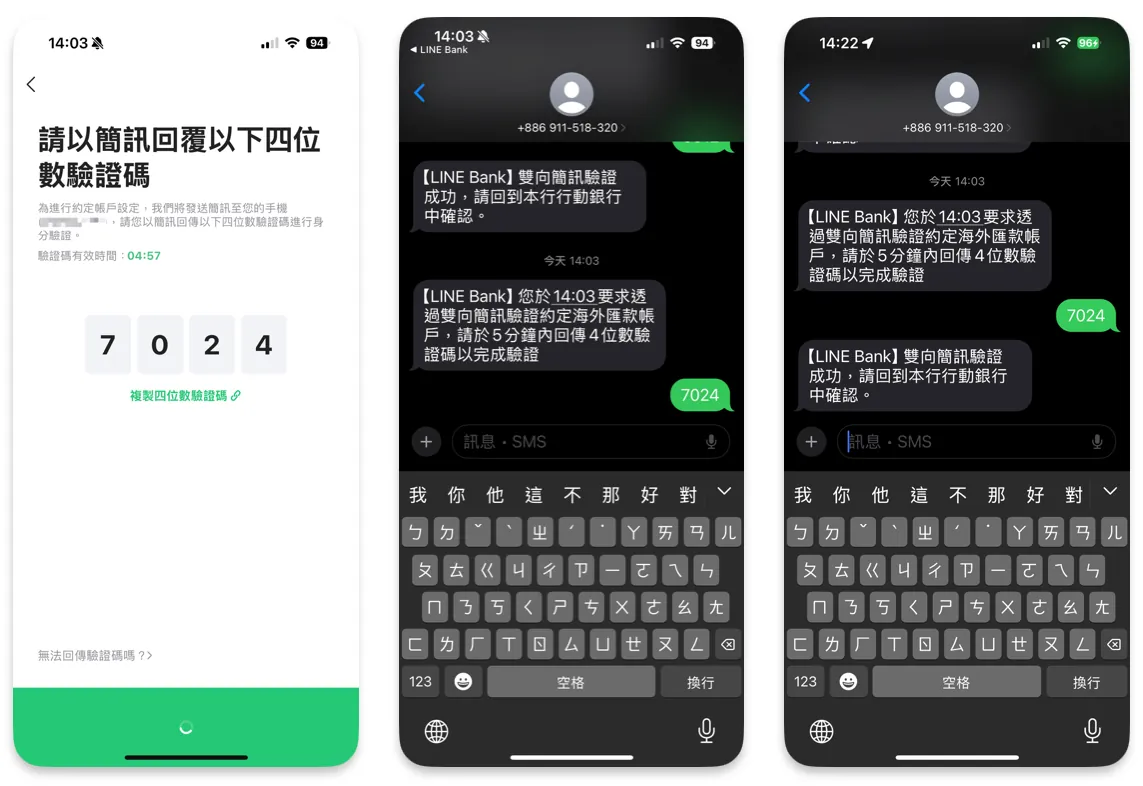

You need to complete two-factor SMS verification by entering the four-digit code from the SMS you just received; wait about 1–2 minutes, and receiving a confirmation SMS means the verification is complete.

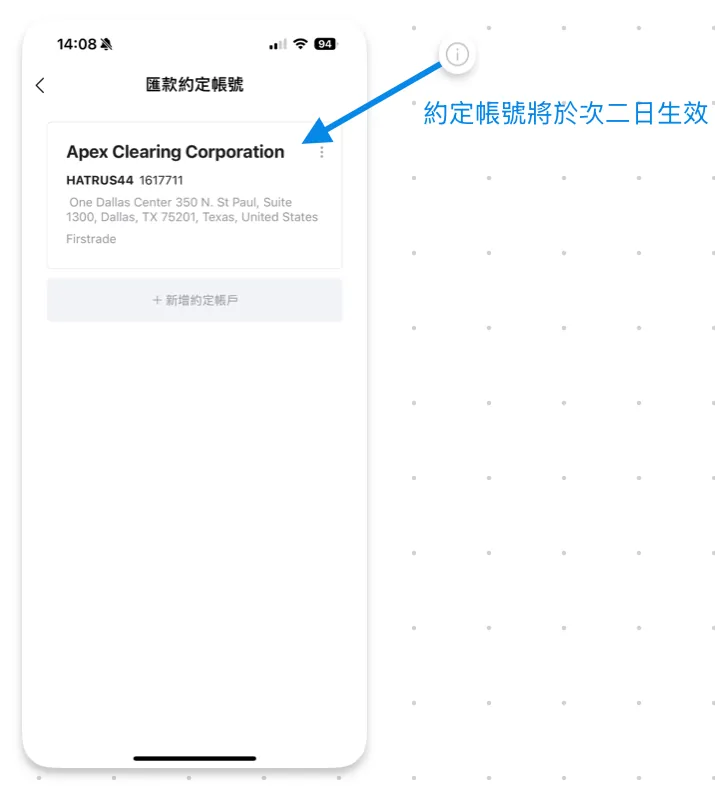

After successful verification, the designated account will be added successfully!

After adding, an exclamation mark will appear in the top right corner, indicating it is not yet active.

Becomes effective 2 days later.

Line Bank Firstrade Designated Account Transfer

“My Transfer Records” → “Agreed Transfer Account” → Select account → Enter amount → Choose “Transfer using agreed account” → All information will be filled automatically.

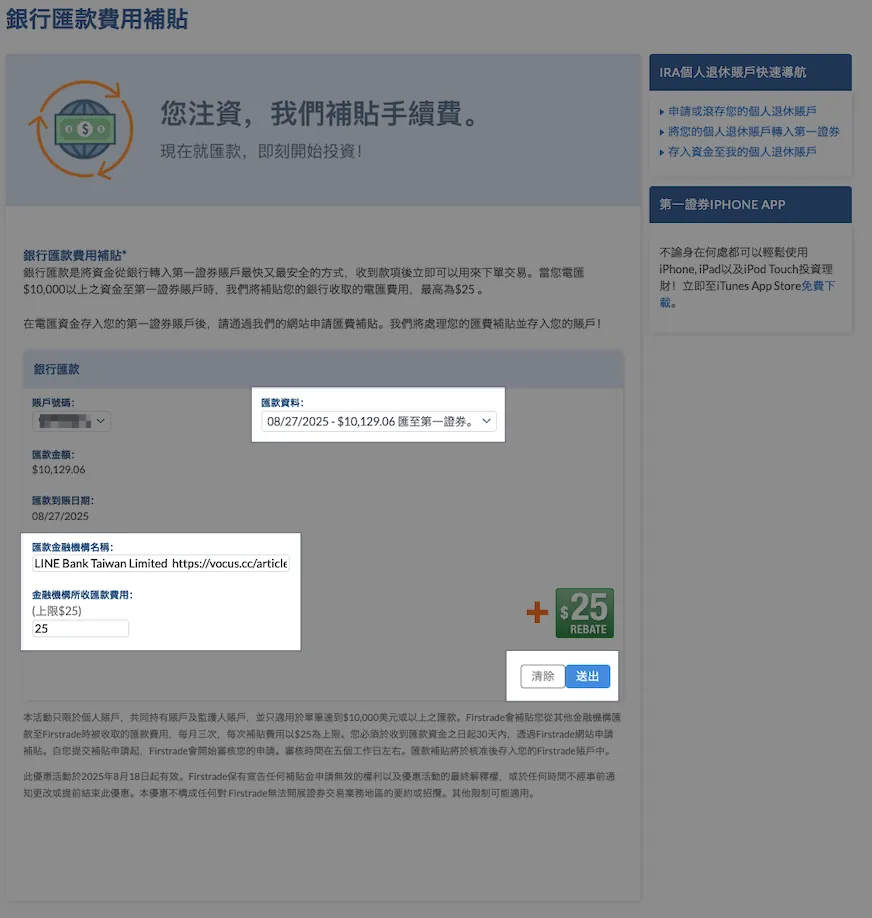

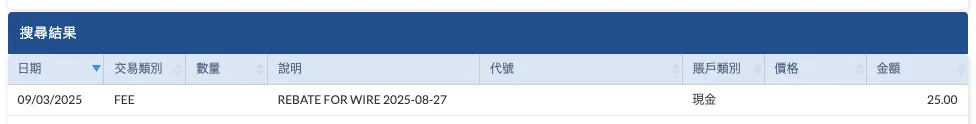

Firstrade Fee Reimbursement Application Guide

Remittance amount requirement: Single transaction over $10,000 USD

Subsidy Amount Limit: $25 USD

Limit: Up to 3 times per month

Application period: Apply within 30 days after the remittance

After logging into Firstrade, select “Customer Service” → “Promotions” → “Wire Fee Rebate”.

Select remittance information.

If the remittance information does not appear, please wait a few more days for it to be updated. (It may not show immediately after the funds arrive)

Select Remittance Record Data:

Remittance Financial Institution Name:

LINE Bank Taiwan LimitedRemittance fee charged by financial institutions:

25

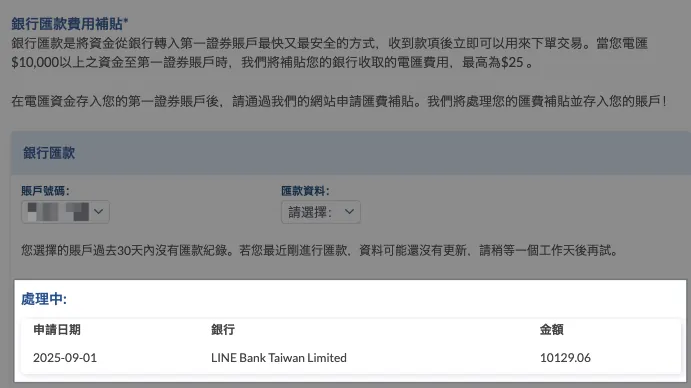

Click “Submit” → “Confirm” to complete the application.

It usually takes about 2–3 business days to receive the remittance subsidy.

You can check the fee subsidy records in “My Account” → “Account Records”.

Firstrade may experience a slight delay of about one day: the application status disappears, and the account record does not show the subsidy; after about a day, the deposit record will appear!

Although LINE Bank only charges TWD 150, the actual remittance fee exceeds USD 25, so we still subsidize USD 25.

Disclaimer

This article is for personal experience sharing only and does not guarantee complete accuracy. Please rely on actual conditions when using. The author is not responsible for any losses incurred.

Anti-Fraud Section

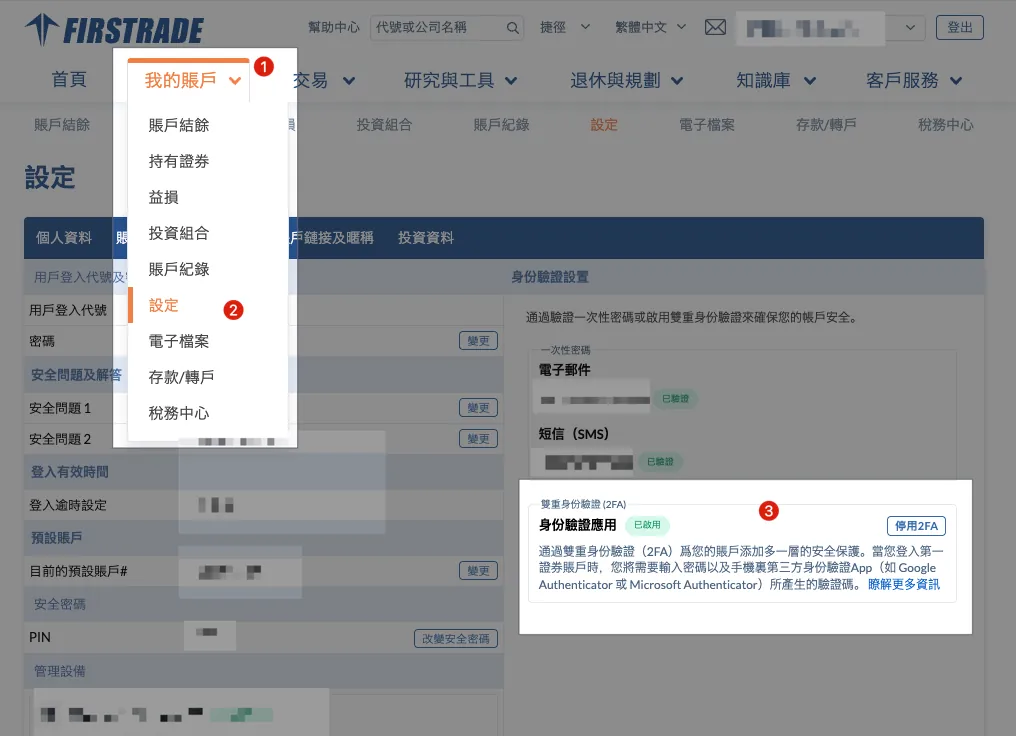

Two-Factor Authentication

Be sure to go to “My Account” → “Settings” → enable “Authenticator App.”

This way, logging in on an unfamiliar device requires completing two-factor authentication first.

Email and Link Domains

No matter how authentic the email looks, always check if the sender is firstrade.com and do not click any links in the email. If you must click, double-check that the URL is from firstrade.com.

Technically, scam emails and fake websites can look exactly the same, making it hard to tell real from fake; regarding URLs:

If it’s not firstrade.com, it’s a scam! It’s a scam! It’s a scam!

If it’s not firstrade.com, it’s a scam! It’s a scam! It’s a scam!

If it’s not firstrade.com, it’s a scam! It’s a scam! It’s a scam!

If you have any questions or feedback, feel free to contact me.

This post was originally published on Medium (View original post), and automatically converted and synced by ZMediumToMarkdown.

{:target="_blank"} (up to three times per month)](/assets/e4d139fe0685/1*-4JN2hY_QP3oZaon2BES0A.webp)

{:target="_blank"}](/assets/e4d139fe0685/1*4xi8pHeUNAPZKijWiXfj1Q.webp)